The only equity fund in the UK focused on this one simple strategy

IFSL RC Brown UK Primary Opportunities’ strategy is unique to all other UK equity funds in the market because it focuses exclusively on equity raises.

One small UK equity fund has a process built into its strategy that offers exposure “simply not available to the typical retail investor” and its manager is anticipating record amounts of activity this year to boost it.

The £20m IFSL RC Brown UK Primary Opportunities fund focuses almost exclusively on buying into UK companies raising money through primary placings, secondary placings, initial public offerings (IPOs) and rights issues.

Manager Oliver Brown said this process makes the strategy is different to all other UK equity funds in the market because it is the only one that concentrates solely on equity raises.

Brown said the strategy works because “we are buying in nearly always at a discount to where the shares were trading at, so we’ve got a bit of downside protection already built in”.

“If a company wants to issue new shares, it will typically do so at a at a discount that tends to be free of stamp duty and free of commission, so you’re not adding cost to the fund,” he explained.

“It also gives investors access to a part of the market that is simply not available to the typical retail investor – and that is placings, IPOs, sell downs – which very much the preserve of institutional investors.”

Equity raises – where institutions buy into companies often at a discount to prevailing market price – do have many typical UK equity funds participating, but not with the same exclusive focus as the IFSL RC Brown UK Primary Opportunities fund.

Brown said that many investors often assume the strategy must be volatile due to the hyped nature surrounding many IPOs.

However, because IPOs only make up a small part of the portfolio, it is less volatile than the average fund in the sector, with a second quartile annualised volatility of 18.56 over the last three years.

Around 20 per cent of the portfolio is made up of IPOs, whilst 40 per cent comprises primary placings, 16 per cent secondary placings and the rest is through rights issues or the secondary market. It currently has 77 holdings.

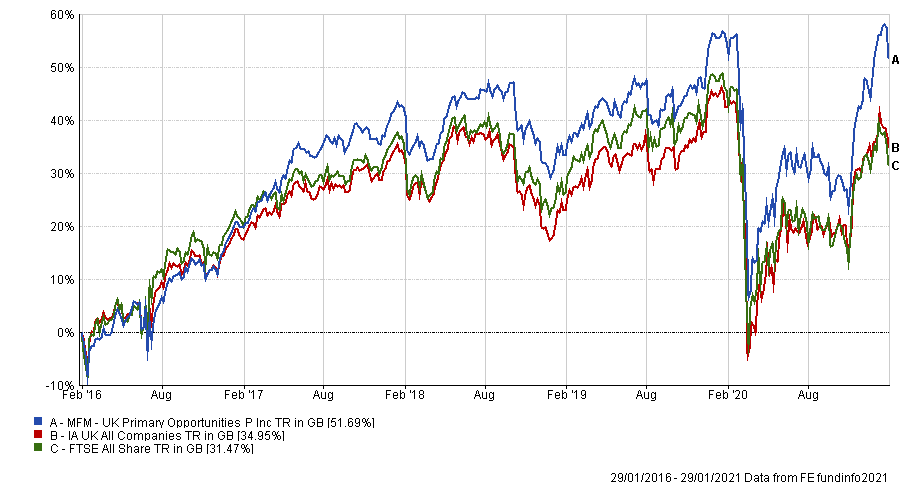

This strategy has seemingly paid off over the last five years, with IFSL RC Brown UK Primary Opportunities returning 51.69 per cent versus 34.95 per cent from the IA UK All Companies sector and 31.47 per cent from the FTSE All Share benchmark.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Although there is no explicit investment style tilting it towards growth or value, Brown said the fund could be considered to have a growth bias. This is because most companies are raising equity to expand their business.

For example, he did not invest in Ocado during its IPO because he felt it was too expensive. But when the pandemic struck and the company raised money to expand, Brown decided it was a game changer for the company in the UK and their overseas expansion plans.

“So Ocado, a great business, but my goodness it was on a very high valuation, but I will happily buy something like that,” the manager said.

“However, I’ll be quite pleased when an opportunity for a more modest, more cheaply rated primary opportunity comes along, because I feel that somewhat balances out the very high valuation of Ocado.

“There’s a growth bias, but we like to have a well-balanced portfolio across different companies, different sectors, different market caps.”

He wouldn’t put IFSL RC Brown UK Primary Opportunities into a value bucket even though sometimes the fund will participate in rights issues or secondary placings to rescue struggling companies – typically at the higher risk end for the fund.

“We invest in them pretty infrequently, because it’s probably not met my quality thresholds if it’s got itself in such a mess,” Brown said.

However, there are exceptions to this, particularly when there is a turnaround story in the making and management has been changed. Brown’s expectations of gains for these instances are in the 40 to 50 per cent range.

He said: “Our natural habitat is a good quality company that’s already floated and it’s raising another 10 per cent of its market cap because it’s buying a bolt on acquisition, it’s raising a bit more money because it wants to expand, it’s going into new territory or it’s got a new product.

“That’s our bread and butter and that is I would argue is the lowest risk way of investing for us.”

IFSL RC Brown UK Primary Opportunities has an active approach, which differs from the Renaissance Capital IPO Exchange Traded Fund (ETF). This follows a rules-based approach by buying the largest, most liquid, newly listed US IPOs five days after listing and simply holding for two years.

The ETF has done well in recent years, benefitting from the surges of the likes of Peloton, Uber and Zoom, which have surged since going public.

Where IFSL RC Brown UK Primary Opportunities differs is it buys stocks at the IPO price that’s agreed between the company and other institutional investors.

Brown said: “We don’t buy them five days later, because actually we tend to find the good ones are probably up 20 per cent by that stage and we certainly don’t decide to sell things at a certain cut-off price in the future.”

Some its largest holdings are some of the well-known FTSE 100 names such as AstraZeneca, Royal Dutch Shell and HSBC, but its biggest active holdings also include smaller firms like HeiQ, Creo Medical, and Diaceutics.

Brown is excited for the year ahead, which he believes is going to be a record year for equity issuance.

“At the moment is there’s a huge amount of money that is going to be raised this this year, more than any time the last decade,” he said.

“Last year you saw about £25bn raised on the UK stock market. This year it’s going to be higher I’m pretty sure.

“There’s a lot of companies actually now looking to expand into the expected economic upturn and there’s still a little bit of money that needs to be raised for companies that are struggling.

“This is an IPO market that has been pretty quiet UK for the last few years, not helped by Brexit, so we have a backlog and we’re now starting to see them come through.”

Indeed, Dr. Martens jumped in its market debut last week to 425p at open, versus its issue price of 370p, and there could be similar investor appetite for the upcoming Moonpig IPO.

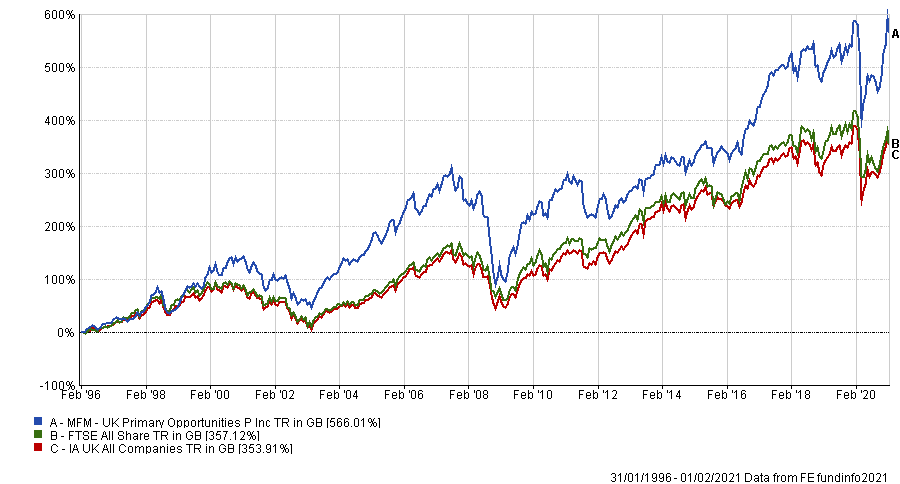

Performance of fund vs sector and index since launch

Source: FE Analytics

Since inception in 1996, IFSL RC Brown UK Primary Opportunities has returned 566.01 per cent, versus 357.12 per cent from the FTSE All Share benchmark and 353.91 per cent from the IA UK All Companies sector.

It has an ongoing charges figure (OCF) of 0.86 per cent and a 2.15 per cent dividend yield.