January update – early 2020 strength fades as Coronavirus fears take centre stage

We participated in one primary opportunity – IG Design raised money to acquire a US business in what is anticipated to be a materially earnings enhancing deal.

In January, the IFSL RC Brown UK Primary Opportunities fund returned -1.51% compared with –3.25% for the FTSE All Share and -2.40% for the IA UK All Companies sector.

Hopes at the start of 2020 were high for further progress in global equity markets as global growth remains solid, hence expectations of a recession relatively low. A more constructive view on a trade resolution between the US and China is also aniticpated. Unsurprisingly, markets rarely follow consensus expectations. America’s killing of an Iranian military leader and the retaliation by Iran saw oil prices touch $70. The market suffered further falls as the number of cases of those affected by the Coronavirus increased and concerns over the effect this may have on the Chinese economy, particularly over the Chinese new year, grew. Oil prices fell sharply towards month end to below $60.

The UK left the EU and is now in a transition period until the year end. We await signs of progress that a thorough trade deal can be struck. UK growth remains pedestrian, albeit, despite the recent post election rally in UK stocks, valuations remain attractive relative to other developed markets. Small-caps have started to outperform and we expect this to continue as the valuation gap relative to mid-caps closes. With close to 30% of the Fund invested in small-caps, we are well positioned for this rise.

In 2020 we anticipate a considerable increase in the amount of money raised on the UK market, now that greater certainty exists, and an increased focus on UK equities given their lowly valuation. 2019 saw circa £17bn* raised and we expect this to increase materially as companies look to grow and IPO activity increases. Market conditions in 2020 should provide plenty of fertile primary opportunities for our investors.

Please be advised that the past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested

*Source: London Stock Exchange

Purchases

IG Design

IG is a manufacturer and distributor of gift wrapping paper and packaging. We acquired the shares as part of a £120m placing to fund the acquisition of a US company, that further grows their presence in the world’s largest market. IG has an impressive track record and the shares have already appreciated >10% since purchase.

Sales

Argentex

We trimmed our holding in this currency exchange provider to SME’s on strength. The shares have appreciated more than 80% since IPO last year.

Clinigen

We used a positive trading update to take profits and exit our remaining modest holding in this healthcare company.

Cumulative Performance (Total Return %)– January 2019

| Fund/Benchmark Name | Year to 31/01/2020 | 3 Years to 31/01/2020 |

5 years to 31/01/2020 |

Since Inception (28/05/1997) |

|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 13.00 | 27.69 | 56.20 | 432.22 |

| Quartile Ranking – IA UK All Cos | 2 | 1 | 1 | 1 |

| IA UK All Companies | 13.19 | 20.12 | 36.60 | 280.81 |

| FTSE All Share | 10.67 | 18.44 | 35.61 | 286.65 |

Discrete Annual Performance (Total Return %)– January 2019

| Fund/Benchmark Name | Year to 31/01/2020 | Year to 31/01/2019 | Year to 31/01/2018 | Year to 31/01/2017 | Year to 31/01/2016 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 13.00 | -4.34 | 18.13 | 19.78 | 2.14 |

| Quartile Ranking – IA UK All Cos | 2 | 2 | 1 | 2 | 1 |

| IA UK All Companies | 13.19 | -5.62 | 12.45 | 17.60 | -3.30 |

| FTSE All Share | 10.67 | -3.83 | 11.28 | 20.06 | -4.63 |

Source: FE 2020

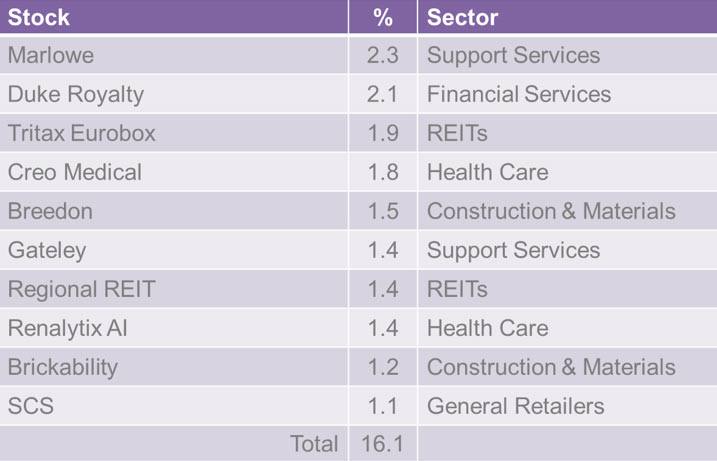

Top Ten Active Holdings

Source: RCBIM as at 31 January 2020

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk